Join our buy-renovate-sell projects in Denmark’s most promising markets.

Secure, Asset-Backed Investments in Danish Real Estate

Our investment model combines high-yield property redevelopment with fixed-income mortgage assets — allowing investors to participate in either or both, depending on their risk-return appetite.

3-Part Model

🏚 Buy, Renovate, Sell

We acquire undervalued properties in strategic Danish locations, conduct value-adding renovations, and exit at favorable resale prices — sharing profits with co-investors.

📄 Pantebreve – Secured Loan Investments

We originate or acquire Danish mortgage bonds (Pantebreve) backed by physical properties. These provide stable, fixed annual returns and capital security for our investors.

🏗️ Structured, Transparent, Compliant

Every project or loan is backed by registered legal documentation, third-party valuations, and traceable digital records within Denmark’s property and mortgage systems.

10 +

Years of Experience

0

Investor Losses to Date

22 M+

Active Secured Loans

12 +

Investor Countries

Secure, Asset-Backed Investments in Danish Real Estate

Stability, transparency, and enforceability — Denmark offers one of the most secure real estate and financial ecosystems in Europe.

✅ Rule of Law: Denmark ranks among the world’s top countries for legal security and property rights.

✅Fully Digital Land & Mortgage Registry: All transactions are visible, recorded, and verified in national registries.

✅Mortgage Instruments (Pantebreve): These fixed-return instruments are legally enforceable and asset-backed.

✅Investor Protection: Contracts are notarized, transparent, and protected under EU-compliant financial regulations.

3-Part Model

Invest in High-Yield, Asset-Backed Mortgage Notes

Acquire performing property-backed loans and receive predictable, contractually agreed annual returns — secured against Danish real estate.

Example Loan Listings

- Property Address

- Loan Amount

- Gym

- Conference

- Library

- Rest Room

- Restaurant

- Bars

- Driving

- Shopping

- Fashion

- Class

Structured, Verified, and Fully Compliant Investing

- Verified through Denmark’s national property registry

- Legally binding contracts & notarized transactions

- GDPR and AML compliant investment onboarding

- Capital stored in segregated client accounts (if applicable)

- Available for legal review by your advisors

Real Estate?

Start with our curated list of available loans and active development projects.

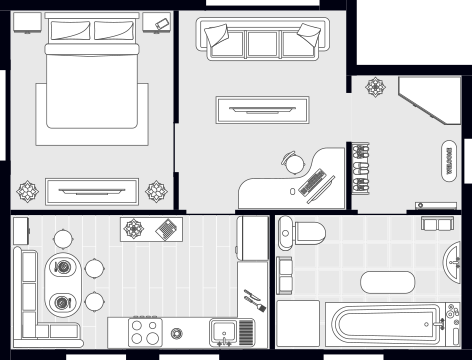

Luxury House Overview

- Join Our

1200+ Community

Apartment Plans

- Floor 01

- Rooms 05

- Area M2 600

- Parking 300

- Space 780

- Floor 02

- Rooms 04

- Area M2 500

- Parking 400

- Space 1200

- Floor 03

- Rooms 04

- Area M2 1200

- Parking 250

- Space 1800

- Floor 04

- Rooms 05

- Area M2 2200

- Parking 350

- Space 3000 Sqf

- Floor 06

- Rooms 06

- Area M2 900

- Parking 400

- Space 2250 Sqf

- Floor 07

- Rooms 06

- Area M2 500

- Parking 280

- Space 1500 sqf

Built for Security. Structured for Growth. Trusted by Investors.

Asset-Backed Security

Every investment — whether in a property or a loan — is backed by real, registered Danish real estate. Your capital is protected by legal collateral, not speculation.

Predictable, Transparent Returns

We provide clear projections, full documentation, and real-time updates on all investments. No hidden fees. No vague promises — just data-driven outcomes.

End-to-End Expertise

From sourcing undervalued properties to executing renovations and structuring mortgage-backed instruments, we manage the full process in-house to protect your investment.

International Investor Friendly

We work with clients around the world. Our process is fully digital, with English-language support, easy onboarding, and legally compliant investor access from anywhere.

Regulated & Verified

All transactions and properties are traceable in Denmark’s official Land and Mortgage Registries. Legal contracts are notarized, enforceable, and aligned with EU standards.

Aligned Interests

We invest alongside you. When you succeed, we succeed — ensuring full alignment of risk and reward.

What Our Investors Say

RYCO makes it easy to invest in Danish property without living there. Everything was clearly explained, the documents were in English, and the returns were exactly as forecasted.

Sophia M.

I appreciated seeing the properties before and after. These aren’t abstract investments — they’re tangible, traceable, and well managed.

Ali K.

I’ve now invested in two mortgage-backed loans through RYCO. The documentation is solid, the team is responsive, and the returns have been reliable.

Jonas L.

Schedule A Visit